Alternative payment methods

The power of real-time payments in boosting game sales

January 17, 2025

The future of fast payments is here

The gaming industry and the world of payments are constantly innovating. This article looks at real-time payments (RTP) and open banking —2 trends reshaping how gaming’s ecommerce landscape can accelerate transactions. We’ll cover real-time payments, how they work, where they’re used, and —most importantly— how they will change the game for developers and publishers going forward. Real-time payments: instant gratification Real-time payments enable instant fund transfers, allowing users to send and receive money in seconds. This technology is revolutionizing the industry by offering:- Faster transactions: Reduced processing times mean quicker access to funds.

- Enhanced user experience: Seamless and convenient payments can increase customer satisfaction.

- Increased revenue opportunities: New payment options can attract more players and drive revenue growth.

- Tailored offers based on spending habits.

- Streamlined checkout processes and automatic top-ups.

- New financial services products designed specifically for gamers.

- A rise in digital payments during the global pandemic

- Payment modernization initiatives

- Consumers demanding more convenient payment initiation and authorization methods

- Increased access to RTP capabilities for new entrants

- Advances in digital overlay services allow for more seamless and expedited experiences

- APIs and open banking promote improved accessibility to new payment rails

- Less reliance on cash thanks to government-backed initiatives

- Global government acceptance of RTPs fueling stronger GDP and local business economies

- Heightened interest in and acceptance of alternative payment methods by consumers.

What are real-time payments?

Real-time payments, also known as instant payments, are digital payments that allow funds to be transferred between accounts in real time, 24/7, 365 days a year, regardless of holidays, weekends, or periods of bank inactivity. This means the funds are immediately available to the recipient as soon as a payment is initiated. Imagine a world where every game-related purchase —from a new skin to a premium currency bundle— is processed instantly. No more waiting for transactions to clear. That is the power of real-time payments. As the gaming industry continues to expand, global real-time payments will play a crucial role in shaping the future of gaming transactions. By embracing this technology, game developers and publishers can provide their players with a seamless and efficient payment experience, increase revenue, and expand their market reach.How real-time payments work

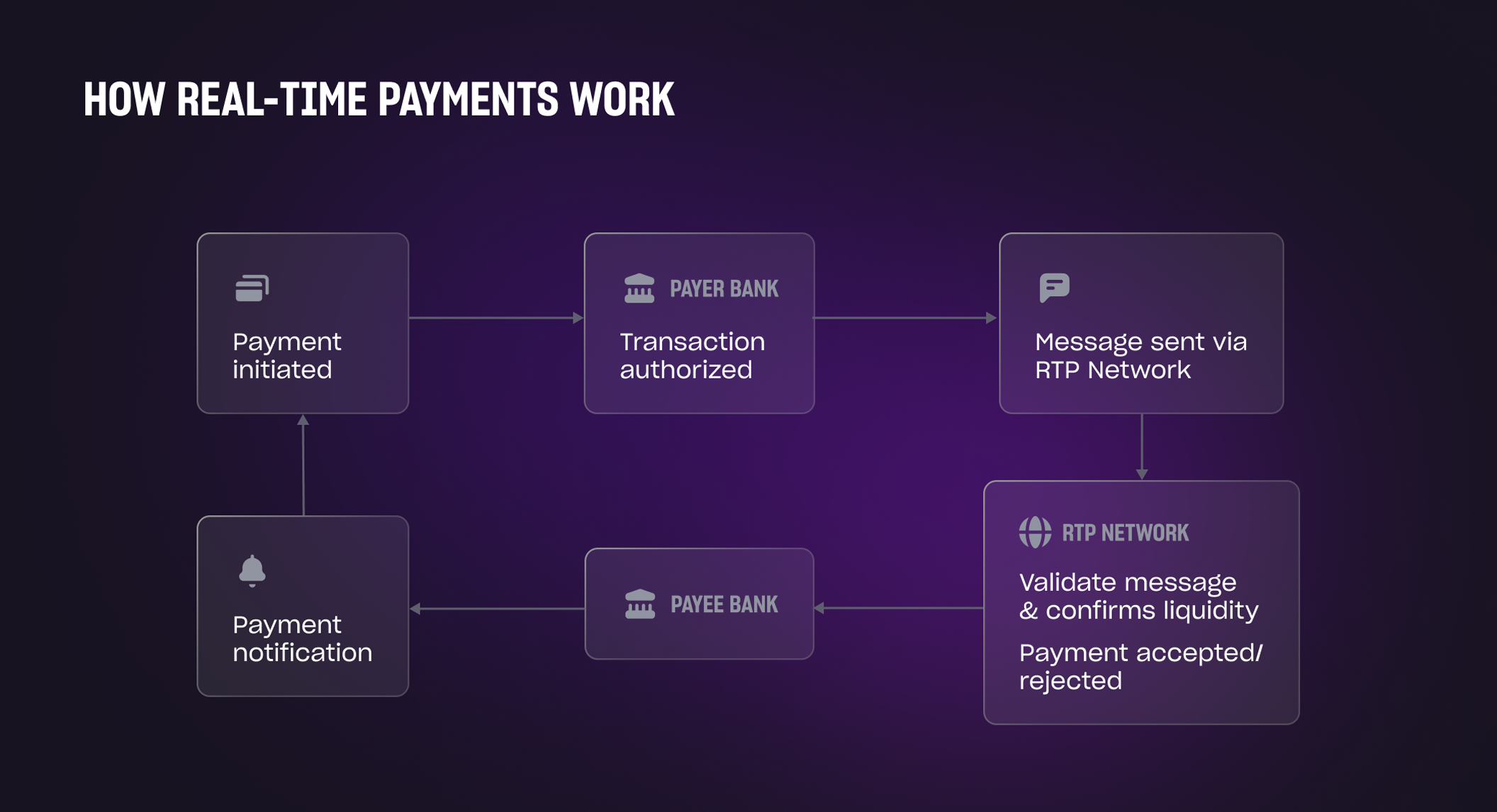

A real-time payment involves 5 parties:- The payer

- The payer’s financial institution

- The payee

- The payee’s financial institution

- The RTP network

When a player makes a game-related purchase, a unique code containing payment details (like the amount) is sent to their device. To confirm the purchase, the customer’s bank system works jointly with the merchant’s bank system to authorize this code within a gaming app or web shop and to finalize the transaction.

The RTP network acts as a fast, reliable intermediary that verifies funds and authorizes the payment. This network is significantly faster than traditional banking methods, ensuring customers’ purchases are processed instantly rather than taking hours or days typically required by ACH and wire transfers.

When a player makes a game-related purchase, a unique code containing payment details (like the amount) is sent to their device. To confirm the purchase, the customer’s bank system works jointly with the merchant’s bank system to authorize this code within a gaming app or web shop and to finalize the transaction.

The RTP network acts as a fast, reliable intermediary that verifies funds and authorizes the payment. This network is significantly faster than traditional banking methods, ensuring customers’ purchases are processed instantly rather than taking hours or days typically required by ACH and wire transfers.

RTP examples

Today, more than 70 countries support real-time payments with regional differences defining each country’s RTP networks. RTP in the US: A new payments era

In recent years, the US has seen a significant shift toward real-time payment systems. These systems allow for instant transfers of funds between accounts, offering faster and more convenient financial transactions. Three major real-time payment networks have emerged in the US:

RTP in the US: A new payments era

In recent years, the US has seen a significant shift toward real-time payment systems. These systems allow for instant transfers of funds between accounts, offering faster and more convenient financial transactions. Three major real-time payment networks have emerged in the US:

- Real-Time Payments (RTP) Network: Launched in 2017 by banking consortium The Clearing House.

- FedNow: Backed by the Federal Reserve, FedNow is a real-time payment and settlement service. It launched in July 2023, and as of March 2024, upwards of 470 financial institutions have signed up, representing approximately 5% of the total.

- Zelle: Operated by Early Warning Services and launched in 2017, Zelle is a consortium of major US banks—Bank of America, Capital One, JP Morgan Chase, PNC Bank, Trust, US Bank, and Wells Fargo. It is a popular peer-to-peer payment service often used for person-to-person payments.

- The UK’s Faster Payment System (FPS) was launched in 2008. FPS is the flagship real-time payment system, catering to multiple British banking institutions by enabling nearly instantaneous payments between accounts.

- India’s Immediate Payment Service (IMPS). Since 2010, IMPS has offered an instant, 24/7 interbank electronic fund transfer service. Customers can access IMPS through different channels, such as mobile phones, ATMs, SMS, and web browsers.

- India’s Unified Payments Interface (UPI) system —launched in 2016 by the National Payments Corporation of India— is the largest market player by volume, with 89.5 billion transactions.

- Singapore’s PayNow. The Monetary Authority of Singapore introduced PayNow in 2017 to serve Singapore’s participating banks with real-time payments across accounts and allow customers to make payments with mobile numbers, National Registration Identity Card numbers, or Unique Entity Numbers.

- Australia’s New Payments Platform (NPP) was founded in 2018 to support real-time payments between accounts. NPP also offers PayID, an innovative system that allows users to make payments using easy-to-remember information like a mobile number or email address instead of traditional bank account details. The NPP has garnered strong support from both the Australian government and consumers. In 2021, the government leveraged the platform to disburse over $12 billion in COVID-related support payments. This demonstrates the NPP's scalability and reliability in handling large-scale transactions. NPP has seen widespread adoption, with over 90 million customer accounts linked to the system at 107 financial institutions. This rapid growth highlights the increasing popularity of real-time payments among Australia’s consumers.

- Brazil’s Pix was launched in 2020 by Banco Centro do Brasil. Pix allows banking customers with a bank account, payment institution account, or prepaid payment account to make instant payments year-round every day.

- More than half of Sweden’s population uses Swish, an app that facilitates real-time payments between individuals and between individuals and businesses.

- Thailand introduced PromptPay to consumers in 2016. Before the service’s launch, Thailand’s consumers made an average of 48 digital transactions per year. With the introduction of PromptPay, the number rose to more than 200. Currently, PromptPay is among the fastest-growing real-time payment services in the world, helping to connect many unbanked people to the financial world.

- Mexico’s Sistema de Pagos Electronicos Interbancarios (SPEI): Launched in 2004 by Mexico’s central bank, SPEI runs an accelerated schema that prioritizes transfers for settlement within 30 seconds of a payment request being made.

- SEPA Instant Credit Transfer (SCT Inst) enables <10 second EU credit transfers within an area, eventually growing to span over 36 European countries. 2,388 payment service providers have joined, including 67% of European PSPs and over 71% of EU’s PSPs.

- Chile’s Transferencias en Línea (TEF) was implemented in 2008 as a real-time gross settlement (RTGS) system for large-value and time-critical payments. Transferencias en Línea (TEF) is a fast payment system built in Chile in 2008. Centro de Compensacion Automatizado (CCA) is the operator and owner of TEF —one of the early speedier payment systems in South America— while Comisión para el Mercado Financiero (CMF) is the regulator and overseer for the FPS.

- China’s Internet Banking Payment System (IBPS) is a second-generation payment system operated by the People's Bank of China. It consolidates various commercial banks into a centralized RTP system.

- Kenya’s PesaLink has been providing 24 x 7 x 365 real-time payment services for the country’s banking industry since 2016 and is trusted by over 3 million customers who make upwards of 200 billion transactions.

- With DuitNow in Malaysia, consumers can send money instantly to mobile, NRIC, or business registration numbers.

- Real-Time Clearing (STC) in South Africa. While this system has been operational for 17 years, real-time payments have not been widely adopted. Several factors have contributed to this slow uptake, including limited consumer awareness, limited participation by financial institutions, and higher fees for RTPs. In 2023, the country launched PayShap, a mobile-friendly instant payment system that aims to revolutionize how people and businesses make payments through cost-effective bank-to-bank transfers, mobile transfers, direct-to-customer pay requests, and retail payment services integration^.

RTPs’ game-changing benefits

Real-time payments are revolutionizing how we transact, and the video game industry is no exception. RTP can benefit game developers and players in many ways by offering faster, more secure, and more convenient payment options.

- Speed. By processing transactions instantly, gaming and other ecommerce merchants can streamline their operations, reduce processing delays, and eliminate the manual intervention required for failed non-RTP transactions. This translates to both time and cost savings. However, the appeal of RTP extends beyond mere speed.'

- 24/7 X 365 accessibility. Traditional banks can be slow and limiting and don’t align with the 24/7 nature of the gaming industry. Real-time payments (RTPs), on the other hand, allow for instant transactions —a huge benefit for game developers and publishers, especially those who need to process microtransactions, royalty payments, or international transfers.

- Improved customer focus. This can drastically improve the gaming experience, especially for digital purchases like in-game items, DLC, or premium subscriptions. For example, a player could instantly buy a new skin or power-up and start using it immediately without waiting for traditional payment processing times. This streamlined approach can lead to higher player satisfaction and increased engagement.

- Enhanced security. By implementing stronger payment security measures, like two-factor authentication and device binding, merchants can significantly reduce the risk of fraudulent transactions. Additionally, new payment methods like Request to Pay offer a more secure way to process payments through verified channels. This means gamers can enjoy more peace of mind when making in-game purchases.

- Cash flow. Immediate payments for game sales and services provide a real-time view of a studio's financial health. This clear picture of cash flow allows for more accurate future projections. Instead of relying on slow or inaccurate estimates, studios can make informed decisions based on financial performance.

- Lower costs, higher profits: Real-time payments can significantly reduce operational costs. Unlike traditional credit card transactions, they bypass intermediaries like Visa and Mastercard, meaning no interchange fees, which can be as high as 4% per transaction.

- Broader, more inclusive reach. Many potential gamers face barriers to traditional banking —such as age restrictions or less-than-stellar credit history— limiting their ability to make in-game purchases or access digital marketplaces. Real-time payments provide a more inclusive way to transact. By enabling cashless payments for a wider range of users —banked and unbanked— game developers and publishers can tap into a larger market, thereby increasing the odds of boosting revenue.

RTP’s future vision

Real-time payments are a powerful tool for the gaming industry, offering the potential for faster, more efficient transactions. However, current RTP systems often operate within national borders and depend on other countries’ systems’ ability to communicate with each other. The full potential of RTP enables seamless cross-border payments and opens up new opportunities for global gaming markets. For example, Singapore's successful integration of PAYNow with Thailand's PromptPay in 2021 demonstrates how all countries should steer their interconnection efforts and showcases the future of global RTP. By embracing real-time payments worldwide, the video game industry can unlock new opportunities, enhance the player experience, and drive global gaming’s growth.How Xsolla simplifies global payments

Real-time payment (RTP) networks are great for domestic transactions, but they often fall short regarding international payments. These networks are designed with local markets in mind, making cross-border payments complex. The good news is that Xsolla offers a solution. With a single, easy-to-integrate API, ecommerce merchants can access a wide range of global RTP networks, including Pix, PayNow, PromptPay, and more. This simplifies the payment process and expands reach to players worldwide. Here are a few successful use cases that benefit our partners. Pix According to Xsolla data, Pix accounts for 57.5% of all the payments in Brazil in 2024. Pix afforded our partners the following yearly comparative growth:- Generated sales: +166.24% (2022 vs. 2023)

- Conducted (successful) transactions: +146.15% (2022 vs. 2023)

- Conversion rates: +12.5% (2022 v 2023)

- Generated sales: up to more than 1000% (2023 v 2024)

- Conducted (successful) transactions: up to more than 1000% (2023 v 2024)

- Conversion rates: +25.3% (2023 v 2024)

Popular

GET THE LATEST CONTENT DELIVERED TO YOUR INBOX

Featured content

5 minute read

Game Sales and Commerce

Getting players to purchase with UX optimization

Learn how strategic UX can drive engagement and encourage players to buy in-game enhancements and items.11 minute read

Payments

The power of real-time payments in boosting game sales

Integrating a more robust payments strategy into your ecommerce business plan could be the key to more sales, revenue, and improved metrics.5 minute read

Payments

The rise of parental controls

The gaming landscape is changing - is your studio prepared to safeguard young gamers and ensure a safer gaming landscape?DIGITAL GUIDE

Free guide

BOOST PLAYER ENGAGEMENT WITH REWARDS

Learn how you can grow your community with rewards during all stages of your game development. Download our free guide.

READY TO LEVEL UP?

The Xsolla team is ready to help.Your game business is our #1 priority.